Let’s be honest—how many videos have you watched today? No judgment. We’re all in the same boat. Reels, TikToks, Shorts...

Customer Loyalty in Retail Banking

Finance is a time-worn practice, but technology has disrupted it like any other industry. As consumer loyalty shifts to the rhythm of the digital banking sea, rigid institutions will get swept up in its wake. Thus, we’ll examine the changing finance industry, with a focus on factors impacting customer loyalty towards digital and traditional banks.

Customer Loyalty Topics of Discussion

- The relationship between traditional and digital banks.

- How small banks can differentiate themselves with fewer digital products than big banks.

- Why digital banking appeals to younger generations.

- Why people stay with their current financial institutions.

- Problems with current acquisition tactics in building customer loyalty.

- What consumers value most in banking.

- The spectrum of satisfaction in customer banking.

- The outlook for traditional and digital banking.

The Current Financial Landscape

Sometimes necessity is the mother of collaboration.

Partnerships between brick-and-mortar institutions like Green Dot Bank with startup, digital-only providers like Chime testify to the evolving financial sector. JPMorgan has also partnered with fintech companies Bill.com and On Deck Capital.

Industry behemoths make survivalist moves in partnering with neobanks and fintechs. J.D. Power’s 2018 U.S. Retail Banking Satisfaction Study reports that digital-only customers comprise 28% of retail banking. This trend will continue as online banks become more sophisticated, and large banks have already reaped rewards by digitizing. Citibank and JPMorgan, for example, have the greatest concentration of digital-centric customers, which is currently 47%, also per J.D. Power’s study.

Large banks undoubtedly hold such sway over the digital marketplace because they can afford the latest digital products. In 2018, S&P Global Market Intelligence analyzed 15 advanced mobile banking features, such as picture bill pay or being able to view one’s balance without logging in, across more than 60 banks. The study found that megabanks, those with assets of less than $1 trillion, had an average of 13 features. In contrast, banks on the lowest end of the study’s spectrum, with assets between $10 and $50 billion, offered an average of five features.

While smaller banks should ramp up their digital capabilities, these findings aren’t their death knell, either.

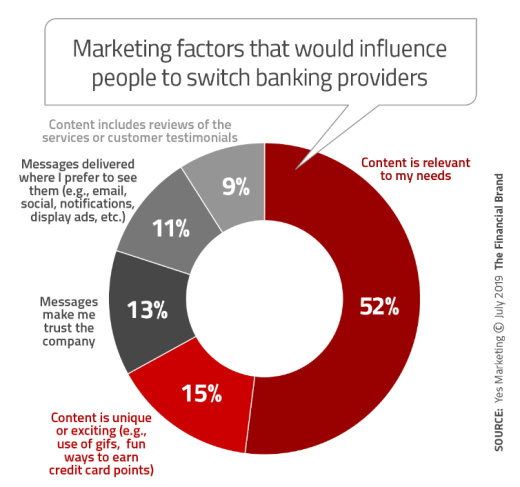

In a Yes Marketing survey of 1,000 respondents, 52% selected “content relevant to my needs” as the primary marketing factor that would influence them to switch banks. The Financial Brand took note of this infographic from the survey.

Since money spent on the wrong audience is wasted, it doesn’t make sense to target people with offers irrelevant to the consumer’s purchase journey. A college student is no more interested in a home equity line of credit than a homeowner is in a student account. If the content happens to reach potential customers at the right time, such as emails about low mortgage rates for someone searching for a home, prospects will be delighted rather than annoyed.

Thus, if local and regional banks focus on the digital capabilities and services most prized by their customers, they don’t need to check off every single digital box. There’s no point in investing in products that exceed the price point the target audience is willing to pay. For example, if market research indicates that most local customers would like peer-to-peer payments (P2P) and personal financial management tools, then an institution should invest in those features.

While virtual banking clearly muddles customer loyalty, most people remain anchored to their legacy institutions. According to J.D. Power’s 2019 U.S. Retail Banking Satisfaction Study, only 4% of consumers switched primary banks in 2018. The lack of switching doesn’t necessarily mean people are fully satisfied with their banks though.

To make sense of the changes in the financial sector, let’s start by identifying the reasons for digital banking’s appeal.

Mobile Lifestyles: In the Yes Marketing Survey, 42% of Gen Z respondents and 37% of millennials selected “ability to manage services via mobile app” among the top three factors they considered in a banking provider. In comparison, 34% of 38- to 52-year-olds selected this feature. Unsurprisingly, only 18% of 53- to 71-year-olds found a mobile app significant.

Millennials’ digital receptiveness makes sense considering they are the most mobile population, often traveling regionally or internationally for work and vacation. As the digital native generation, Gen Z is poised to adopt similar patterns in the workforce. With that in mind, out-of-network fees naturally grate on a traveler’s nerves. Also, the price of wire transfers is astounding when considering the convenience of P2P networks like Venmo and PayPal, which charge a minimal fee and send notifications of money transfers in minutes to people halfway around the world.

High-Yield Accounts: A 2% APY is quite attractive to someone who primarily uses savings and checking accounts. The lack of infrastructure and employees enable digital banks to offer high-yield accounts. These products are ideal for the mobile individual, or someone interested in earning decent interest from their deposit accounts. Add this perk to FDIC insurance, free ATMs, and low or no maintenance fees, and its no wonder younger generations flock towards digital banks. However, the lack of products compared to traditional banks, perhaps even checking accounts, might deter some from this option. That being said, the handicaps of digital banks will likely be resolved as processes become more sophisticated.

Bundling Services: In Cornerstone Advisors 2017 Q3 survey of 2,015 respondents, 40% of consumers who considered megabanks their primary institution would consider a bundled, fee-based checking account from Amazon. For a $5 to $10 monthly fee, the package would include services like cell phone damage protection and ID theft protection. In a culture accustomed to one-stop shops (i.e. Walmart and Amazon’s hold over retail), it’s understandable how open banking has reached such popularity. It’s simply convenient to aggregate the capabilities of multiple tools in one place.

Merchant Apps: While there is a push to centralize banking via mobile, payment methods are still segmented. Indeed, the Apple Card credit card developed in partnership with Goldman Sachs illustrates the marketing tactic of encouraging people to associate certain purchases with accounts. Examples include buying Apple products with the Apple Card to get cash back, and using the Starbucks Rewards Visa Card for Starbucks purchases. The Apple Card also offers financial management tools, such as a color-coded feature tracking a consumer’s card purchases by category. While Apple Card’s success is debatable, its collection of multiple features in addition to its primary function, a credit card, demonstrates the popularity of data aggregation.

Returning to J.D. Power’s 2018 Retail Banking Satisfaction Study, the report found digital-only customers, those who exclusively used online or mobile banking channels during the past three months, to be the least satisfied among banking customers (791 on a 1,000-point scale). In contrast, branch-exclusive customers indicated slightly higher rates of satisfaction, clocking in at 804. Lower satisfaction scores are attributable to three factors in the study: communication and advice, products and fees, and new account opening. When it comes to complex or costly transactions like stocks and mortgages, it’s not surprising people still want in-person advising.

The J.D. Power’s 2018 study also examined people’s willingness to switch banks, and openness skewed younger. Two out of five (40%) of 18- to 21-year-olds and 35% of 22- to 37-year-olds stated a willingness to switch. Older consumers might not only be skeptical of online banking, but also find it irrelevant to their needs. They might incentivized by loyalty programs more than younger generations as well.

The attachment that older populations have with legacy institutions starts early. According to a 2018 Bankrate and MONEY survey, the average U.S. adult has used the same primary checking account for 16 years. This narrative is common: someone opens an account for his child. From there, the child invests her first savings and checking account with the same bank. When it’s time for college, the teenager invests in a student account, unburdened by maintenance fees. By now, the college graduate has developed a deep enough trust with her bank to consult its advisors on mortgage loans. Once she starts a family, she opens a 529 plan for her own child, and the process repeats.

It’s undeniable that local and regional banks have an edge over large banks with customer loyalty. This advantage directly stems from community involvement. The widespread vision of a megabank as an impersonal entity, a suit that pushes one along through a loan process with no personal attention, won’t fade from the mainstream soon. Indeed, returning to the Cornerstone Advisors survey, only 15% of consumers who considered a community bank or credit union their primary financial institution would consider an Amazon bundled, fee-based checking account.

People feel connected to their communities when everyone at the local branch knows their name. This investment in local community is also partly why credit unions are often seen as preferable to banks. Credit unions are viewed favorably because of their nonprofit status, the ease of securing loans with them, and their lower interest rates. If people rooted in a community believe their financial provider serves a purpose beyond profits, they’ll be more inclined to pay a bit more for services.

It’s not just nostalgia and community that keep people using the same banks and credit unions, however.

In some cases, the inertia stems from people not knowing how good, or bad, a deal they are getting. It might be a hassle to switch from an account with a 1% APY to one with a 1.05% APY. Granted, people who earn virtually nothing on their deposit accounts might be astounded by such rates. Some checking accounts charge thousands of dollars to avoid monthly fees. Chase, for example, charges $12 a month if an individual does not maintain a daily balance of at least $1,500. Stiff maintenance fees make it particularly difficult for low-income individuals to maintain accounts in traditional banking systems.

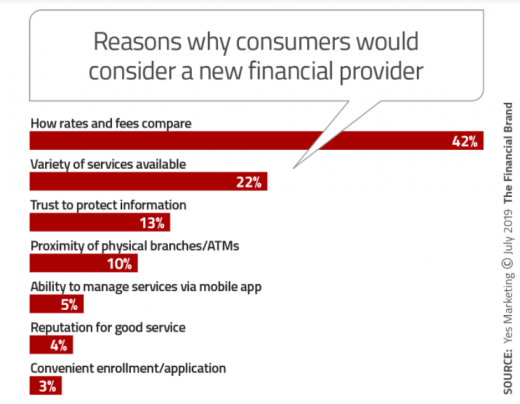

The fear of fees is an old pain point. Unsurprisingly, in a Yes Marketing survey, 42% of respondents selected “rates and fees” as their primary reason for considering a new financial provider. Resolving distrust isn’t as simple as it seems, however. People will be leery of hidden fees even if the sticker price is attractive. The Financial Brand pulled the following infographic from the Yes Marketing Survey:

Banks will often offer sign-up bonuses, ATM fee rewards or cash-back options to alleviate the fear of fees. Of course, smaller banks struggle to compete with larger ones over such incentives. For example, Chase offers one of the highest sign-up bonuses at $350. The bank more than makes up for such an offer in maintenance fees of course. If a bank acquires a new customer based on a generous sign-up bonus, however, it can easily lose one when a competitor presents a similar offer. Also, if a customer switches banks because of a sign-on bonus and lack sufficient funds to maintain an account, then he won’t stick around. Therefore, such acquisition tactics might not yield the best lifetime value customer if they aren’t part of a larger customer loyalty campaign.

Drawing on the Yes Marketing Survey once more, 57% of consumers cited rate and fee transparency as the single most important factor in building trust. The digital savvy consumer will deduce if an account with a lower sticker price has hidden fees among other caveats. If people feel deceived, then get ready to send a legion of employees to monitor your Google reviews. In fact, hidden fees are part of the reason sign-up bonuses have lost their edge; no one wants to read through pages of stipulations to see whether they meet all the requirements.

With the features of both digital and physical banks in mind, let’s return to the 2018 J.D. Power study one last time. While digital-only customers cited lowest satisfaction, digital-centric customers, those who used a branch once in the past three months and primarily used online or mobile banking cited greater satisfaction than branch-exclusive customers. Digital-centric customers indicated a satisfaction score of 808, compared to 804 for branch-exclusive customers.

The segment with the highest satisfaction overall was a hybrid of digital and physical bank users. Branch-dependent digital customers, or those who used online or mobile banking but had visited a branch two or more times in the past three months, scored 823.

In that case, banks should focus less on the rate at which customers switch institutions, and more on how often customers spread their finances across competitors. The strategic consumer segments his accounts. Why not reap the rewards of both high-yield deposit accounts and in-person advising? Thus, institutions large and small can bank on segmented customer loyalty.

Key Takeaways

- Partnerships between digital and traditional institutions are steadily rising.

- Large banks have the most digital products, but not all are necessary for customer loyalty.

- Smaller banks and credit unions still hold an edge over big banks due to community involvement.

- Marketing products relevant to the customer journey is a viable way to get people to switch banks.

- In order to stay competitive, smaller banks should research the digital capabilities that are most valued by their customers.

- Open banking will grow due to the values of younger generations (high-yield accounts, convenience, etc.).

- Traditional customer loyalty tactics should complement a larger campaign strategy to maximize long-term value

- Consumer satisfaction ranks from lowest to highest in the following sequence: digital-only, branch-dependent, digital-centric, and branch-dependent digital.

- Segmented consumer loyalty will continue to rise.

If you’re interested in optimizing customer loyalty and retention, feel free to email or give us a call. We’re always available to talk about what solutions would be unique, and best, for your business.

Written by Steve Morrison, Vice President and General Manager of Charleston, Asher Agency; and Marisa Sloan

More of our thoughts

Culture isn’t something written on a wall — it’s something you feel the moment you walk through our doors or jump on a call with our team.

The A-Team headed southwest to attend the Restaurant Leadership Conference and join industry leaders from across the country.