The marketing landscape is in the midst of a transformative era, driven by the advent of artificial intelligence.

The Importance of Knowing Your Audience

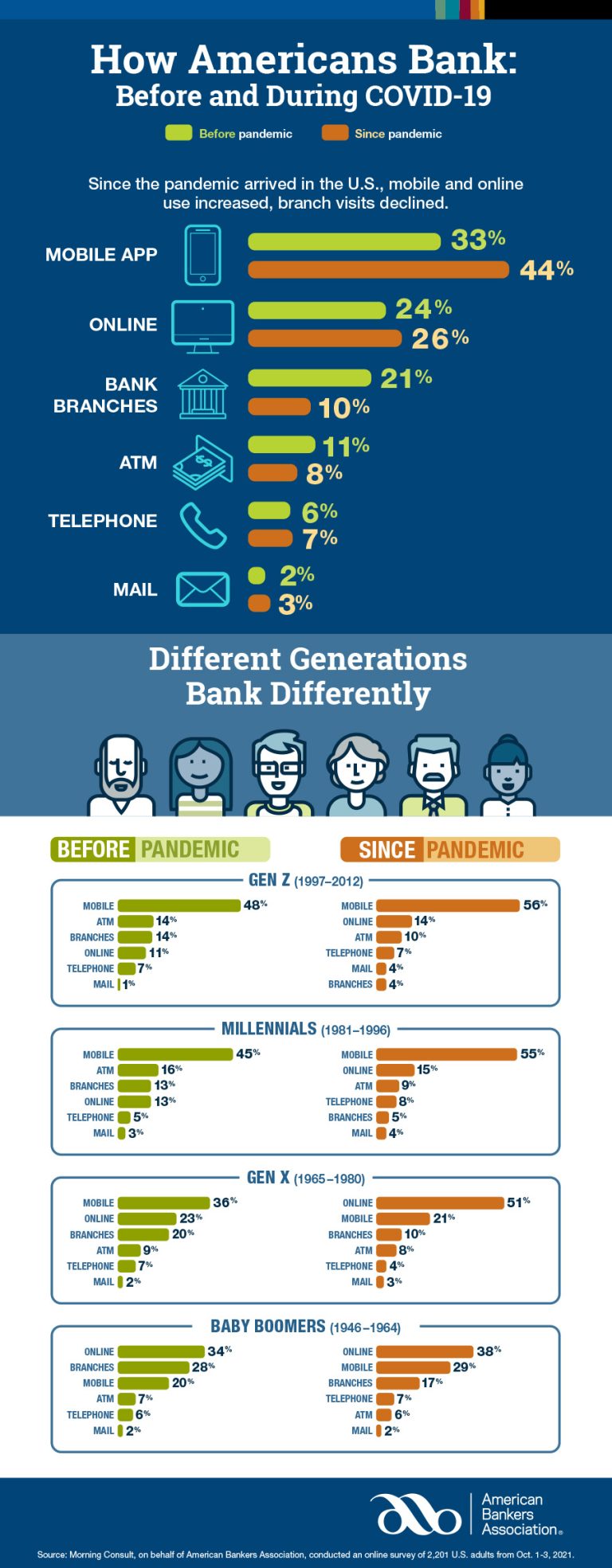

The pandemic has touched almost every aspect of our lives, causing ripple effects across several industries. This includes banking. Americans have changed how they bank since the pandemic, relying more heavily on mobile and online banking. While this trend makes sense, it does mean banks and credit unions need to make changes not only to the products and services they offer, but also in how they speak to consumers.

Asher has been working with banks, credit unions and other financial institutions for decades. While the pandemic certainly was a unique situation, it does not change the fundamentals of marketing and communications. One of the most important aspects of consumer communications is understanding your target audience. To truly be effective, you cannot assume anything or make blanket strategies for all audience segments. To successfully communicate with consumers today, you must go deeper.

Know your audience.

A major part of financial institution marketing is zeroing in on the right target audience. When it comes to financial marketing, a one-size-fits-all approach just doesn’t work today. Consumers are savvier than ever and want to be heard, not just treated like a herd.

Banks, and especially credit unions, often cater to a particular audience. For example, a large, national financial institution will often attract different customers than a local credit union. So, talking to them in the same manner just doesn’t make sense.

It’s vital to communicate with people based on where they are in life and what they need. You need to know your various audiences and their expectations. Generational marketing is a great example of this.

A recent study by the American Bankers Association® illustrates how different generations bank differently.

Millennials, people born between 1981 and 1996, are not only in a different stage of life than their Boomer counterparts (born between 1946-1964), but they also have different expectations and want different experiences. As you can see from the chart below, Millennials vastly prefer mobile banking, both pre and post pandemic. Boomers, on the other hand, prefer online services. And while this may not seem like a major difference, it is when it comes to how your market your financial services to them.

It’s not only important to recognize your audience, but you also need to know where to reach them and how to talk to them. Many financial institutions rely on emails to reach their audiences. However, it is also vital to ensure that all of those emails also feature responsive design so they work equally well on mobile devices.

You can also see from the chart that since the beginning of the pandemic in-branch banking has fallen in every age group. While this makes perfect sense during lockdown, there is a great chance that this trend will continue. Suddenly, in-branch signage and other communications are not as important. Now you must find new ways to communicate with consumers while they are engaged. Of course, this includes digital messaging for mobile and web, but you should also consider other options, such as exterior signage near ATMs.

Don’t make assumptions.

Another study conducted by the ABA found that overall, consumers give high marks to their digital banking experience with 81% of those surveyed saying tech improvements are making it easier to access financial services. The surprising part of this study is that it’s not just younger consumers who bank digitally. While it’s true younger generations have a stronger preference for mobile or online banking and are less likely to visit a branch than older counterparts, a surprisingly high number of Boomers and Gen Z consumers bank digitally as well. In fact, according to the ABA, three out of four Americans used a mobile device to bank in the past month. Nearly half of all bank customers aged 65+ used their mobile device to manage their accounts in the past month.

This information illustrates why you shouldn’t make assumptions about demographic groups. Instead, you need to focus on research, strategy and more, which is exactly what you get with Asher.

Just the beginning.

At Asher, we have extensive experience in the highly competitive financial services industry and specialize in understanding why consumers select their financial institution as well as specific products and services. We’re also experts at ensuring the right offers get to the right customers.

Asher understands what it takes to make a financial brand relevant in today’s competitive marketplace across many different audiences, all of whom have different preferences and habits on how they interact with your institution. We know where and how various audiences consume media, and what their passion points, expectations and financial needs are. We utilize data and research to garner insights that empower our financial partners to build meaningful, impactful and relevant connections with consumers—the type of connections that build and maintain trust as a means to grow market share, enhance customer loyalty and create a point of difference for your institution among your competitors.

Asher’s services include:

- Strategy and Insights

- Brand Development

- Creative Services

- Digital Marketing

- Media Planning and Buying

- Web Development

- Public Relations

- Video and Photography

- Sponsorship Management

Let us help you create financial marketing that effectively communicates to each of your target audiences. We have experience and expertise in providing the strategies, solutions and stories that resonate with today’s competitive and ever-changing financial landscape. Reach out to Asher today.

More of our thoughts

Asher is proud to partner in the distribution of news, facilitating media interviews, and amplifying the results for The Fitness Index.

An apt metaphor for Asher’s 50th anniversary, all the things our team has accomplished and the people who have made it all possible.